Attorneys To Work For You

Our Free 15-minute Consultation

The Internal Revenue Service (IRS) had assessed a Trust Fund Recovery Penalty (TFRP) against our client for unpaid payroll taxes Our California tax attorneys filed a request for a collection due process hearing and convinced the IRS Appeals Officer that its determination that the client was liable for the TFRP was erroneous in its entirety, saving our client almost 1 million dollars.

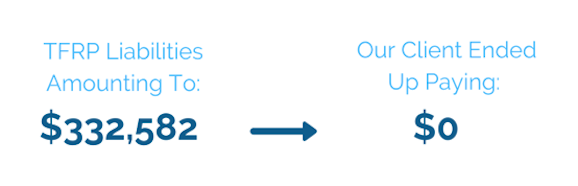

Our tax lawyers successfully defended a corporate employee against imposition of an IRS trust fund recovery penalty (“TFRP”). The IRS sought to impose personal liability against the employee for unpaid corporate employment taxes of $332,582. We were able to reduce the TFRP liability to zero.

Our firm litigated a case before the California Unemployment Insurance Appeals Board resulting in relieving a corporate officer of a California Employment Development (EDD) claim for over $200,000 in personal liability for California payroll taxes which the EDD argued were due under the EDD's equivalent of the trust fund recovery penalty.

The IRS sent our client, a medical transcription company, a Notice of Determination of Worker Classification. The Service sought employment taxes from our client of $477,618 (plus interest) for a year period.

The Solution:We filed a lawsuit in the United States Tax Court, and on the eve of trial the IRS conceded that our client owed nothing. We also obtained an attorneys’ fee award for the client, against the IRS on the ground that the IRS’ position in Tax Court was not substantially justified.

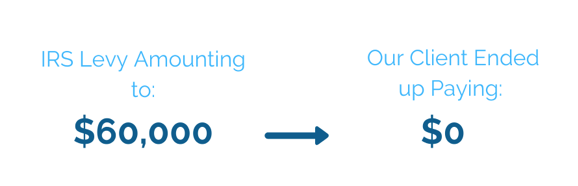

At the time this client came to us the IRS had levied on his wages for a trust fund recovery penalty of approximately $60,000 after his CPA had submitted several unsuccessful offers in compromise. Ultimately the IRS conceded that no tax was due.

The IRS determined that our client owed a tax debt of approximately $155,000 based upon a trust fund recovery penalty imposing personal liability for corporate payroll taxes. We convinced the IRS that our client was not a responsible officer, and nothing was owed.

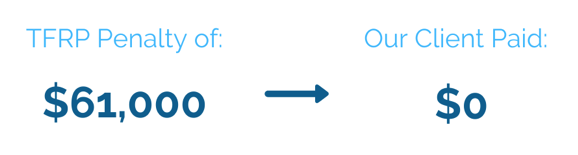

The IRS determined that our client owed a tax debt of approximately $61,000 based upon a trust fund recovery penalty imposing personal liability for corporate payroll taxes.

The Solution:After our intervention, the IRS Appeals Division conceded that a mistake had been made and that our client didn't owe any portion of the trust fund recovery penalty.

Our client incurred a tax debt of over $310,000 due to a trust fund recovery penalty imposed because he was a responsible officer of a corporation which failed to pay its payroll taxes. We negotiated an offer in compromise with the IRS for $33,000 even though our client was earning more than $100,000 annually.

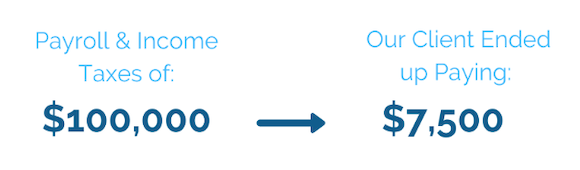

Our client owed approximately $100,000 in payroll taxes, and income taxes. Through our efforts the IRS agreed to accept $7,500 in full payment.

Our client was assessed California payroll taxes in excess of $60,000. After he failed to pay these amounts the Development Department (EDD) served a levy on his bank account, and took all of the funds.

The Solution:After a hearing before an administrative law judge of the California Unemployment Insurance Appeals Board, we convinced the judge that our client was not liable for these payroll taxes and the EDD sent a refund of the entire amount, plus interest.

Our clients owed over $600,000 in payroll and income taxes to the IRS. The IRS Appeals Division Officer accepted an offer in compromise of approximately $270,000 even though the Appeals Division Officer had previously been unwilling to accept less than $386,000 from the clients' prior attorney.

Our client owed over $450,000 in income and payroll taxes. Through a series of actions, including the filing of a case in the United States District Court, a bankruptcy and an offer in compromise, we resolved his debt for $39,230.

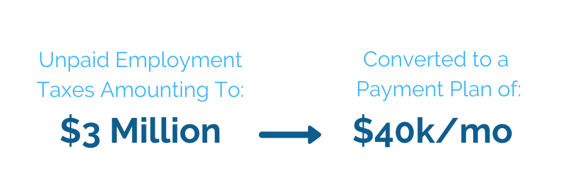

Our client, a highly profitable corporation, owed almost 3 million dollars in unpaid employment taxes to the IRS.

The Solution:Our tax attorneys were able to convince the Internal Revenue Service to agree to a monthly installment agreement payment amount of $40,000 for a repayment term of nearly 6 years.

Further, we were able to persuade the IRS that no Trust Fund Recovery Penalty (TFRP) assessments should be made against the primary "responsible person" of the entity, the corporation's president, chief executive officer and shareholder, pending the successful completion of the installment agreement's repayment terms.

The IRS attempted to impose a Trust Fund Recovery Penalty (TFRP) on our client for the trust fund portion of their corporation's unpaid employment taxes.

Our client owned a 30% in interest in the corporation's business and was a corporate director.

The Solution:Our tax attorneys were able to convince the IRS Appeals Office that our client, who was the corporate secretary, and who had signature authority on all corporate bank accounts, was nonetheless, not a "responsible person" who should be held liable.

This resulted in a full concession by the IRS as to the proposed penalty.A California newspaper distributor was facing a three-year employment tax audit from the IRS. Our tax lawyers were able to minimize the taxes due to only $2,210. Plus, we limited the audit period to only one year.

Our client received a refund of payroll taxes his accountant recommend he pay to the Internal Revenue Service (IRS) after our tax lawyers demonstrated that the IRS had erroneously determined that a disgruntled independent contractor was an employee.

Our client, an evangelical church in Los Angeles, owed the IRS almost $200,000 in payroll taxes based upon a failure to withhold taxes on earnings of school employees. We convinced the IRS to waive almost $90,000 of penalties and interest.

These statements do not constitute a guarantee, warranty, or prediction regarding the outcome of your legal matter.