Attorneys To Work For You

Our Free 15-minute Consultation

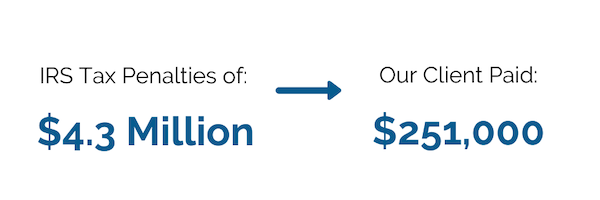

Our client owed over $4.3 million for 1982 through 1986. The IRS rejected a previous offer in compromise by the taxpayer which was prepared by his CPA. The IRS accepted our offer in compromise for $251,000.

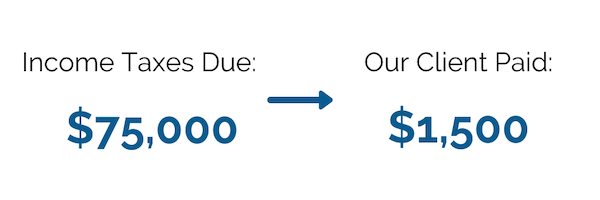

Our client owed the IRS approximately $75,000 in income taxes. The IRS accepted an offer in compromise for $1,500 in full payment of her tax debt. In additional the California Franchise Tax Board (FTB) agreed to treat her $100,000 tax debt as permanently uncollectible without any payment at all.

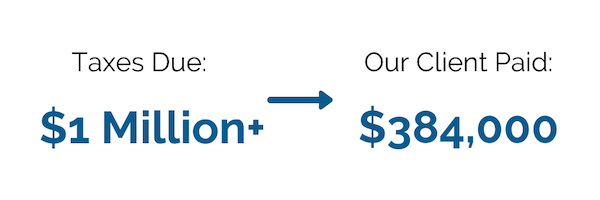

Our client, an entertainer, owed in excess of $1 million. We negotiated an offer in compromise which settled the case for 24 monthly payments of $16,000, allowing our client to keep her interest in a pension plan with assets of almost $500,000.

Our client, the owner of a tanning salon, had been unaware for several years that the business was subject to quarterly federal excise tax liabilities and had accordingly failed to file excise tax returns or pay the tax owed. The IRS was charging them with approximately $650,000 in excise tax liability.

The Solution:Our tax attorneys and paralegals were able to obtain an offer in compromise for our client, and the IRS agreed to compromise the $650,000 liability for one lump sum payment totaling $3,987.

Our client had a tax debt for personal income tax more than $130,000. Although he had substantial assets, we convinced the IRS to accept an effective tax administration offer in compromise for $2,500.

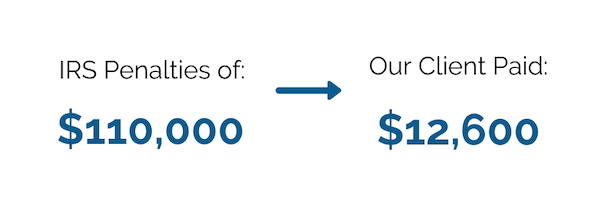

Our client owed the IRS $110,000 in income taxes. The IRS accepted an offer in compromise for $12,600 paid over 24 months at $525 per month.

An offer in compromise submitted by our client's accountant was rejected when the IRS determined that he could afford to pay the total tax due of over $131,000. We convinced the same IRS specialist in offer in compromise to accept less than $30,000.

The Brager Tax Law Group obtained an offer in compromise of $234,411 for a commercial real estate broker who owed the IRS $1,368,000 for an eight-year tax period. We obtained an 83 percent reduction in taxes due. We also obtained an installment agreement of $2,000 per month for the client’s state income tax liability of $331,000.

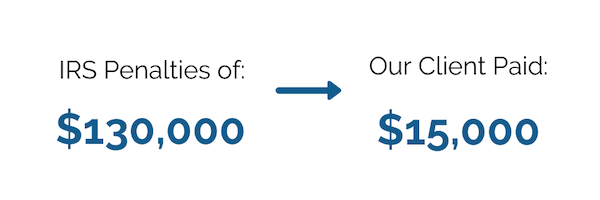

We negotiated a $15,000 offer in compromise with the IRS in settlement of $130,000 in taxes.

Our client owed income taxes to the IRS for 6 years totaling over $131,000. The IRS accepted an offer in compromise for $29,861.

Our clients owed Federal income tax spanning 14 years totaling almost $300,000. Our IRS tax problem lawyers arranged for an installment agreement which limited the payment of tax to $90,000 over the term of a multi-year installment agreement.